Not sure if cryptocurrency CFDs trading is right for you? Check out our tips on crypto CFDs trading strategy, benefits, and possible risks of crypto CFDs on the Avaprimax Blog.

During times of inflation, recession, and market volatility, gold (XAU) is considered a safe investment haven, but only if you know the best trading strategies. But while it’s found on Forex platforms as a Contracts-for-Difference or CFD asset, gold’s not well understood in retail markets.

Thanks to options and futures, you can now trade gold without actually owning any bars, jewelry, or coins, which wasn't always possible. Besides CFDs, XAU is also traded as Exchange Traded Funds or ETFs, which makes trading it much like trading commodities, assets, or stocks.

In metals trading, retail investors simply speculate on how they think the price of gold, one of the safest commodities, is trending, or whether it'll rise or fall. Keep reading this article, which explores how to trade gold in Forex. And touches on several profitable strategies to trade gold if applied correctly.

Trading gold requires that you understand its contract specifications, fundamentals, and character as it's unlike other currency pairs. Metals trade well when there's uncertainty or upheaval in other financial markets, and you can see this in gold's nascent price behavior over the years.

Due to its unique set of fundamentals and lack of an industry-based economy, gold is used for capital preservation. Its price is affected by the risk on or off sentiments of retail traders. And as such it doesn’t respond to attributes of supply and demand.

Because most of the gold that's mined is used in jewelry or investment, its prices respond to fundamentals like;

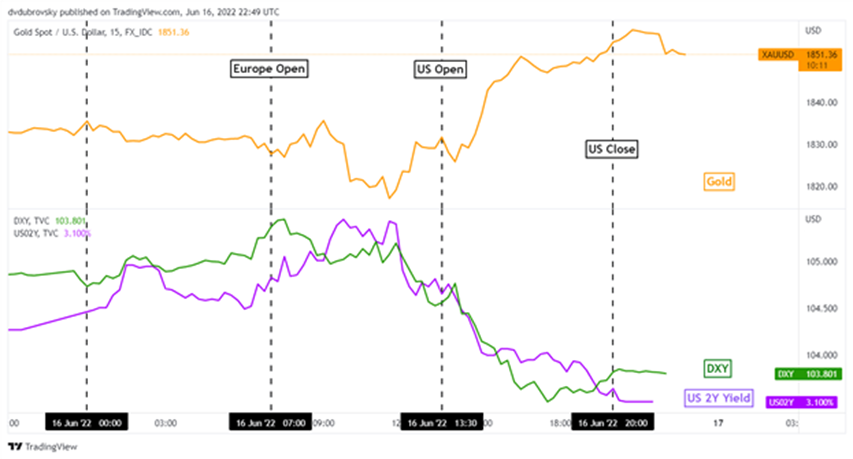

Gold has an inverse value relationship with the US dollar, whose value is spurred by demand for US treasuries. Since the dollar finances foreign investment transactions, gold prices and the dollar's value move in the opposite direction.

US interest rates govern the rate of return on deposits and fixed-income investments like bonds. Low rates dampen profits on treasuries and derivatives. When that happens, the trading focus turns to gold as the haven asset, leading to buying demand and raising prices.

A rise in interest rates makes investments revolving around rate returns like bonds and alternative investments attractive. The focus then shifts from the gold trading price, leading to a reduction in demand, thus lowering its prices.

Risk on and off sentiments suggest that when the focus is to make profits, traders take on volatile markets but move away due to uncertainty and into safe havens like gold. A trader watches the markets closely. Using reliable trading indicators to decide whether to risk on for profitability or risk off for capital preservation.

Generations of humans have valued and treasured gold since early Mesopotamia, mainly due to its appearance and malleability. It’s a benchmark of commerce that’s one of the most ancient forms of currency, and one that hasn’t lost any of its value.

Gold maintains its value and is therefore considered a haven asset during times of wars. As opposed to currency pairs, your XAU trading strategy follows the same factors that underline the high-flying nature of derivatives that are the backbone of market growth.

Strategies you'll use to trade gold are similar to those you employ in currency pair trading, which includes studying:

Traders commonly trade gold alongside the US dollar, although they also have the option to trade it with the Australian dollar, euro, and Swiss franc. Increased geopolitical uncertainty means the correlation with USD has waned, thus trading XAUUSD isn't different from other currency pairs except for the lower volatility.

It's now apparent what fundamentally affects gold prices, including the value of the US dollar, interest rates, and risk on or off sentiment by traders. Your next line of action is to develop a strategy when these economic indexes and market attributes are at play by utilizing an oscillating trading signal.

There are less significant movements in gold charts since it moves more in a direct line within timeframes than purely currency pairs. Prices aren't influenced by monetary or fiscal policies, which makes XAU not subject to the whims of governments or central banks.

To follow informed gold trading tips in Forex, you must take into account the factors that may impact its pairing with a partner that’s subject to inflation pressures. What makes gold unlike other commodities such as oil or corn is that its prices fluctuate independent of supply chain demands, but trader sentiments still drive its major trends.

You can use the same strategy you've developed for trading other currency pairs with gold, but some strategies are unlikely to return. For instance, using a range of XAUUSD trading strategies that work well for such currencies will perform poorly due to the differences in volatility.

Trading strategies are sets of rules that help traders determine whether to enter, manage, exit, or close a position. It can be simple or complex, depending on the trader.

The top gold trading strategies include:

Trading stocks involves studying industry or company-related news. And you'll look at relevant data relating to the pairing currency's geopolitics and economic parameters. But when you trade gold, you'll seek to find out what influences prices. Including hikes during times of uncertainty and inflation fears.

If the currency you've paired with XAU has an inverse monetary relationship, such as the USD, expect that interest rates in that country will push gold prices up or down. Trading futures for gold in terms of CFDs and ETFs is popular with speculative traders. And demand for the commodity affects price movements.

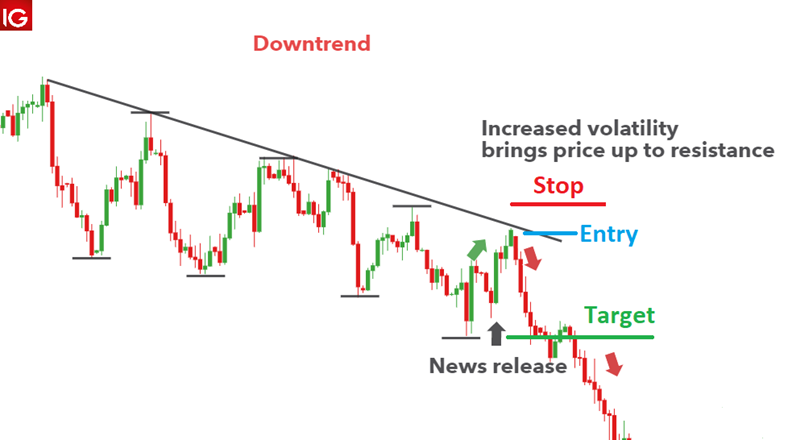

There's a relationship between fundamental analysis and news trading, which refers to gold traders that pinpoint specific news or events to hold positions. Scheduled happenings that impact the economy will have a significant impact on XAU prices. Even for seconds or minutes of trading.

A news trader keeps an eye out for economy-impacting events like central bank briefings, inflation data releases, and Federal Reserve or IRS rate adjustments.

Similar to trading stocks, derivatives, or other currency pairs, you can identify opportunities in the direction of the asset in the market when trading gold. You're essentially speculating that the commodity will continue in its current trend. Before you close a position, or ride it further.

Uptrend in gold trading mean that the commodity price consistently rises by posting higher highs. And the opposite is a downtrend. The best indicator for gold trading will show a XAUUSD signal that’s fairly volatile, resulting in robust trends that form regularly, whether trending up or down.

Unlike scalpers, day traders hold trades for longer, tending to focus on specific times or sessions when they can act on opportunities. Another difference is that day trading involves taking it slow and opening two to three positions at maximum. This is contrast to the tens or hundreds generated by a trend or news scalper.

Day trading suits gold as the instrument is highly liquid with low spreads in comparison to other commodities. The volatility of the XAUUSD trading hours is that volatility in this commodity is high enough for you to find trading opportunities that are present on most days.

You can make your position-holding decisions by the movement of prices for an instrument without incorporating technical indicators. Price action trading strategies include reversals, breakouts, and other advanced candlestick patterns implemented across all timeframes.

On the M15 chart, you can trade a breakout in gold. Which a swing trader could place trades based on that pattern in the H4 charts. Due to the speculative and volatile nature of gold, you can streamline price action with another trading gold futures strategy to filter unreliable Forex gold signals.

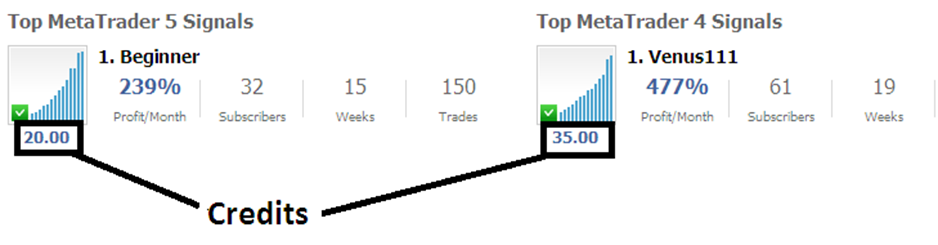

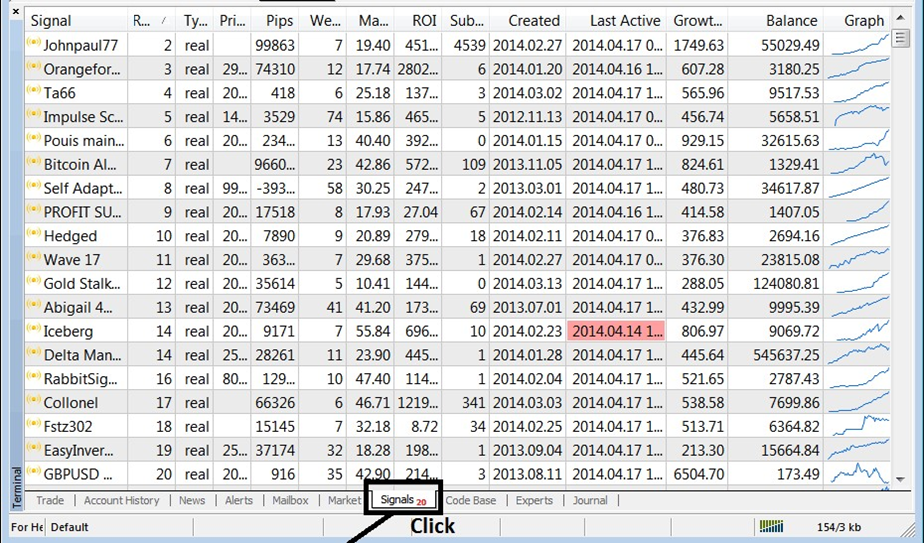

There are a lot of experienced traders and advisors available to guide your gold trading, alongside signal providers that specialize in speculative trades on this commodity. Using a copy trading platform, you can mimic these traders' trades. This is a suitable strategy for beginners or a trader without a solid gold-trading strategy.

Indicators are used to predict the movement of gold prices, including liquidity, relative strength, and symmetrical triangle patterns and indices. You can start by using simplistic technical analysis tools that read into XAU price highs, lows, chart patterns, and trend lines so you'll know how to buy gold futures.

The best gold trading technical indicators include:

The relative strength indicator, being one of the popular indicators for gold traders, indicates whether the commodity is oversold or overbought. If the RSI rises above 70, it’s a reflection of overbought conditions. While one that drops below 30 indicates an oversold scenario.

By enabling you to check values, RSI filters signals. And you can settle for a value below 70 to improve the overall quality of your trades.

A simple but effective technical indicator, moving averages gauge the market's direction. Which is useful to spot trends for gold traders. While also generating entry and exit signals, these indicators help to test parameters and filter out bad Forex gold signals.

Moving average indicators help day trading strategy users to better utilize their selected Forex gold trading hours.

You can represent market volatility using Bollinger bands, a set of three chart lines that historically depict price ranges. Two outer lines represent trading bands where upper and lower prices will move 90% of the time. While the middle shows real-time price fluctuations.

You know the gold market is highly volatile when Bollinger bands contract, and if they expand, you're experiencing low volatility.

Gold is more of a financial instrument than a commodity asset, a foundation of many institutions and investor portfolios. It’s widely used for making jewelry and in the high-tech electronics components industry due to its superconductivity and anti-corrosive nature.

Trading gold requires incorporating components of its price movement fundamentals, technical analysis, and market sentiments. Besides being a haven instrument, XAUUSD signals are attractive. Because the underlying asset is a physical thing, and not a digital file somewhere in an exchange or bank.

Not sure if cryptocurrency CFDs trading is right for you? Check out our tips on crypto CFDs trading strategy, benefits, and possible risks of crypto CFDs on the Avaprimax Blog.

Read about trading exotic currencies: what are the pros and cons? Check out the most volatile exotic currency pairs from our experts on the Avaprimax Blog.

Check out WTI and Brent crude oil trading methods: how to trade oil futures, options, CfDs, and more. Read about spot oil market on the Avaprimax Blog.

What are order blocks in Forex and how to find them? Read about bullish and bearish order blocks and tips on how to include order blocks in your Forex trading strategy.

Read about Forex trading sessions and find out the best time for Forex trading on the Avaprimax Blog. Tokyo, London, and New York Forex market timings: when is the market most liquid?