Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Avaprimax Blog.

Beginning traders often ask, “Can I day trade for a living starting with just $1,000?” Well, $1,000 is not enough buying power to day trade in stocks, but in forex it’s enough to start because many forex brokers have a minimum opening balance requirement of only $100.

Another major advantage of day trading forex over stocks is the leverage that forex brokers offer. Forex brokers offer more leverage than stock brokers because the forex market is significantly more liquid than the stock market. Leverage is essentially when the broker gives the trader more purchasing power in the form of a loan.

For example, with $1,000 of capital and 30:1 leverage a trader can purchase 30 times his capital, or in this case a maximum of $30,000.

This advantage allows his gains to be 30 times as big, but it also means that his losses could be 30 times greater. Needless to say, leverage can be a lucrative, yet dangerous trading tool. The risks of using leverage are beyond the scope of this article and a trader should fully understand these risks before engaging in it.

“Leverage has the potential to turn a reasonably good investment into disastrous gambling.”

Naved Abdali

In this article we will demonstrate two ways to build a $1,000 account:

Let’s make up an example for illustrative purposes. Mister A has been working on a demo account for the past 12 months. Over nearly 1000 deals, Mister A averages about 1 and a half deals per day with a 52% winning percentage. He risks 1% of his capital on every deal. His average reward to risk ratio is 2:1, which means for every two dollars he wins, he loses a dollar. Mister A is excited about his prospects for day trading and he opens up a $1,000 account with a broker.

Deals per month: 33 (1.5 per day with 22 trading days)

Winning Percentage: 52%

Risk per Deal: 1%

Reward-Risk Ratio: 2:1

Based on the above stats, his expectancy formula in month 1 is as follows:

$20 per win x [33 trades x 52%] - $10 per loss x [33 trades x 48%]

= $343.20 - $158.4

= $184.80

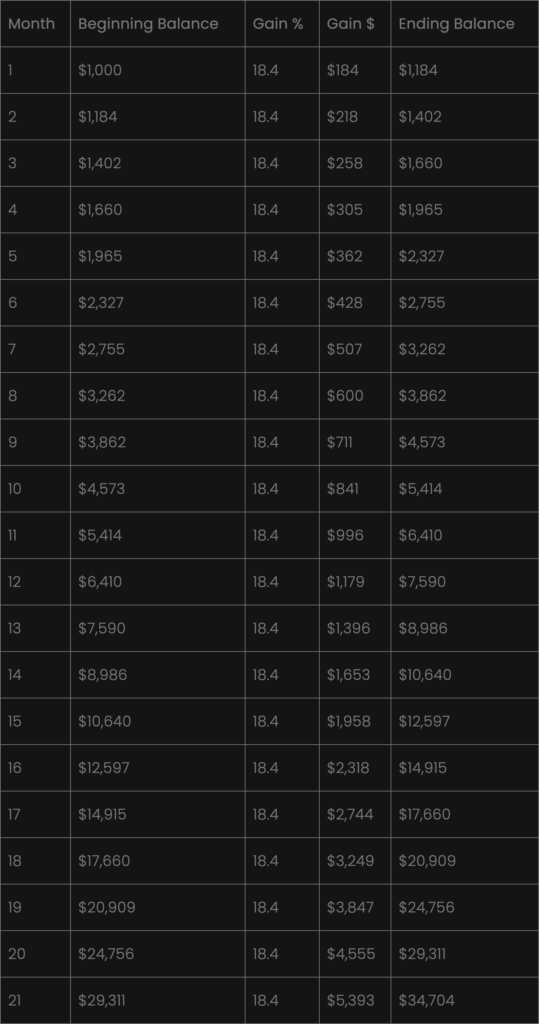

That is an amazing 18% return on investment in only one month, yet parson A only made $184.80. Let’s take a look and see how his equity will grow if he consistently makes that 18.4% per month and doesn’t withdraw any money from his account (assuming it compounds at the end of the month only).

According to the table above, Trader A compounded his account month over month and in month 21 made $5,393 of profit. The average US household expenses in 2020 was $5,011. So if he was that good of a trader (18.4% per month = 220% ROI per year) and was disciplined enough to wait 21 months before withdrawing a penny, he could withdraw his profit in month 21 to pay his bills.

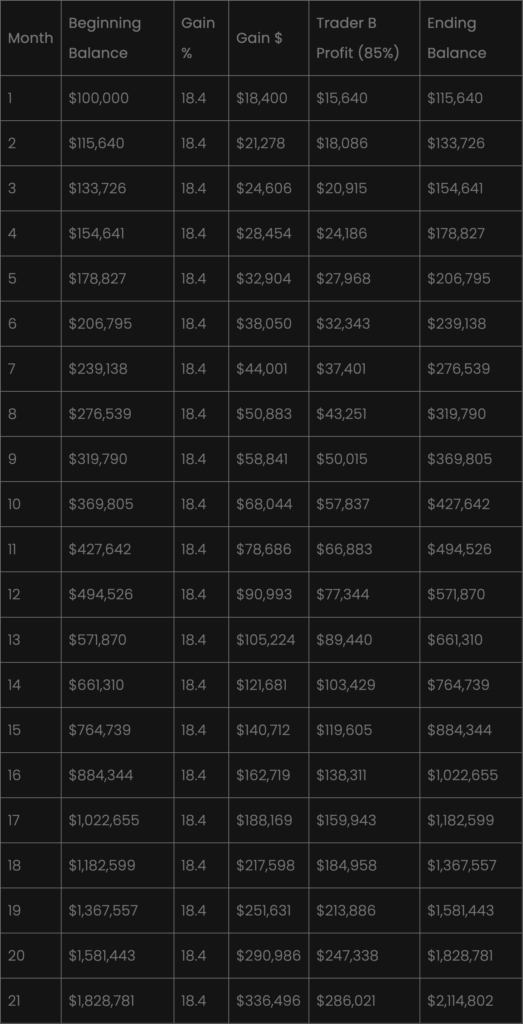

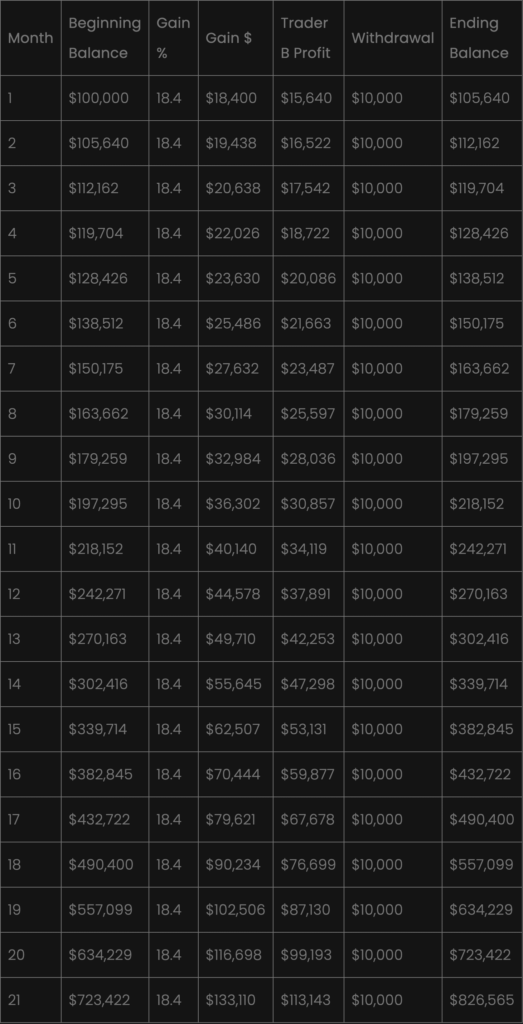

Let’s imagine that Trader B has the same stats and the same success in 12 months trading with a demo account. Instead of opening up a $1,000 account with a broker, he uses the $1,000 to purchase a $100,000 evaluation with Avaprimax. After two weeks B made 10% profit and passed the evaluation. Now Trader B is funded with a real live $100,000 account. After only one month, he made a whopping $18,400 in profit. Obviously that’s enough to live on already, but just for fun let’s imagine two different scenarios.

See the below table where Trader B does not withdraw any profit for the first 21 months and makes more than $286,000 in month 21, trading a $1,800,000 account.

See the below table where Trader B withdrew $10,000 per month from month 1 for the first 21 months (a total of $210,000) and still makes more than $113,000 in month 21, trading a $723,000 account.

As we clearly see, Trader B whose percentage gains are exactly equal to A is so much better off than A. These are the extraordinary benefits of trading in a funded account with a proprietary trading firm like Avaprimax.

Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Avaprimax Blog.

Are you thinking about using the breakout strategy? Check out tips on breakouts trading from our experts on Avaprimax Blog. Read about false breakouts and build your winning strategy.

Read about news impact on Forex. How to understand forex news? Explore how to trade the news in Forex market: trading strategy from our experts on the Avaprimax Blog.

What is a stop-loss and how to use it? How to determine stop-loss and where to set it? Difference between the stop loss and stop limit on the Avaprimax Blog.

Read about emotions in trading and check out how can you master your trading psychology. Build your trading confidence with our tips on trading psychology.

Check out the best indicators for swing trading in our article and trade with maximum profits. Top technical indicators for swing trading on the Avaprimax Blog.

Indicators and tools that forex traders use to identify the direction of the trend. Read how to determine whether a currency pair is in a trending market on the Avaprimax Blog.

What is range trading? How to identify the range? What range trading strategy to choose? Find the answers to these questions on the Avaprimax Blog.

How to be a successful scalper? Check out our scalping tips and techniques. Read our Do's and Dont's and scalp successfully with Avaprimax.

What is order flow? How to read and use order flow in trading? Order flow charts and indicators. Explore order flow trading strategy from Avaprimax experts.