Are you interested in algorithmic trading strategies? Read about algo trading definition, benefits, and disadvantages. Find out if it is profitable and legal.

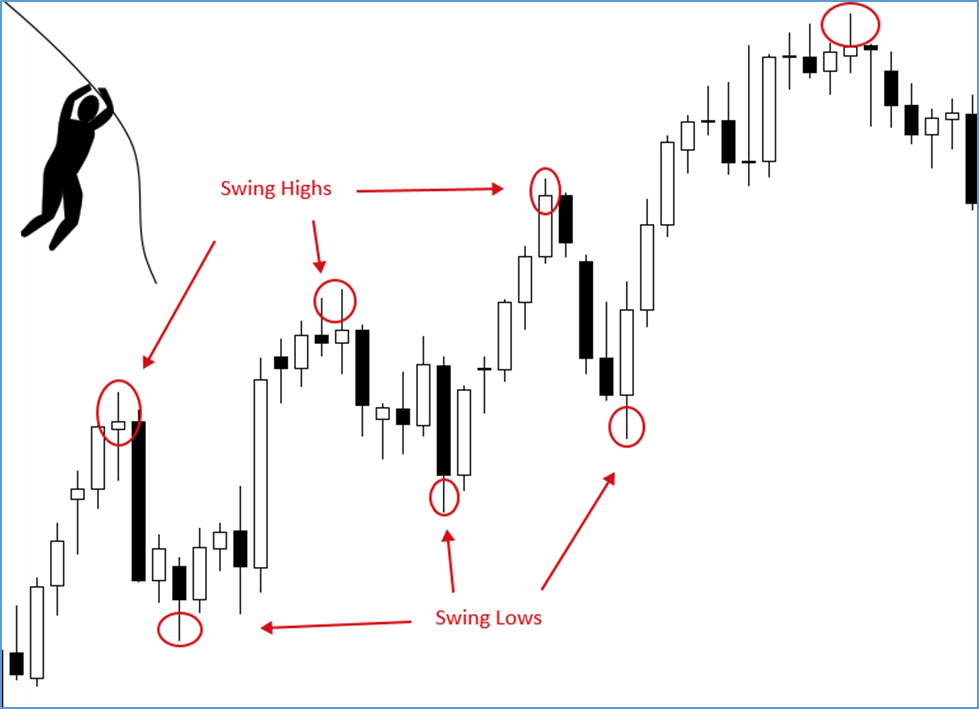

Swing trading is a common strategy leveraged by beginners and professional forex traders looking to take advantage of price swings in the market. The trading strategy stands between day trading and position trading and thus requires patience, as trades can be left to run for days or even weeks.

The swing trading strategy works best with people who don’t have time to stay glued to the screen monitoring their positions. Trades are opened and left to run with take profit and stop loss orders.

Swing traders employ fundamental and technical analysis to determine the ideal levels to open a trade and when to close. The analysis attempts to identify swings within medium-term trends, after which the price is expected to swing to the upside or downside.

The idea is to get into the trade when a new trend or swing starts and ride the wave until exhaustion or correction kicks in. For instance, if a market were moving up, swing traders would wait for the market to correct slightly and enter a buy position at the swing low in anticipation of price bouncing and swinging high in continuation of the underlying uptrend.

Source: Babypips.com

Similarly, if the market moved lower, a swing trader would wait for the price to correct and bounce back slightly to enter a short position at a swing high. By selling at a swing high, a trader will look to accrue significant pips as the price moves lower in continuation of the underlying downtrend.

While swing trading forex, traders utilize various indicators to determine the ideal entry and exit levels. Additionally, traders leverage multiple strategies while swing trading.

There is no definite time frame, which is ideal for swing trading. The time frame refers to the strategy or swing trading technique in play. For starters, swing traders rely on 15 Minutes or lower time frame charts to conduct technical analysis and determine ideal levels where swings are likely to occur. Such traders look to open and close positions within minutes or hours.

Scalping day trading swing trading is one strategy whereby traders rely on shorter time frames to identify potential areas where the market is likely to break out. In this case, the swing traders take advantage of short-term price movements to open and close positions.

On the other hand, swing traders rely on long-term time frames to identify potential swings in the market. By conducting hourly charts analysis, the swing traders can open and leave the positions to run for days or weeks.

Some of the common indicators that traders use in Swing trading include:

The Exponential Moving Average provides valuable insight into the direction price is moving. It relies on the most recent data to affirm the prevailing momentum, making it a preferred fit for traders looking to trade swings in a given direction.

While the EMA determines future trends, it also signals potential entry levels. For instance, prices will always exceed the Exponential Moving Average whenever the market moves up.

Source: Tradingview.com

Therefore, a swing trader will look to enter a long position as soon as the price pulls back close to the moving average and does not close below. Likewise, the traders will exit the position as soon as the price closes below the moving average and moves lower, implying a trend change from uptrend to downtrend.

Source: Tradingview.com

The price will always be below the exponential moving average in a downtrend. Consequently, a swing trader could look to enter a short position as soon as the price pulls back close to the moving average. Conversely, the bounce back provides an opportunity to sell high, anticipating the price edging lower afterward.

While the EMA provides valuable insight into the prevailing trend, the Relative Strength Index sheds more light on the momentum strength. The indicator comes with readings between zero and 100. Readings above 50 imply a buildup in buying pressure, signaling that the price will continue increasing. On the other hand, readings below 50 indicate a buildup in selling pressure, signaling price is expected to tank.

Source: Audacitycapital.com

In swing trading, traders look to enter a long position whenever the RSI reading is below 30 and shows signs of bouncing back and moving up. Any reading below 30 signals overbought conditions. Consequently, there is usually a high chance of the price bouncing back. As the RSI starts moving up, a trader can enter a long position and ride the swing until the RSI reading is above 70.

Likewise, whenever the RSI reading is above 70, a swing trader can look to enter short positions in the market to take advantage of the overbought conditions. The prospect of price reversing and moving lower is usually high.

The Bollinger Bands is one of the best swing trading forex indicators as it signals market volatility. The indicator has upper and lower bands with a median simple moving average. The price is expected to be close to the simple moving average in the middle during balanced market conditions.

Source: Tradingview.com

Swing traders look to take advantage of extreme volatility that causes the price to move and penetrate the upper and lower bands. Consequently, whenever the price rises and shows signs of penetrating the upper band, a swing tarred would look to enter a short position in anticipation of price correcting and moving lower to the middle simple moving average.

Likewise, a swing trader can look to enter a buy position as soon price penetrates the lower band, as there is usually a high tendency for it to bounce back and move to the simple moving average at the middle.

While swing trading is only a trading style, there are various strategies that traders leverage to accrue significant swing trading profits and avoid losses in the market.

Trend following is an effective swing trading strategy that allows traders to always be in sync with the market. In this case, swing traders use two moving averages, one fast-moving and another slow-moving. Consequently, one can use 21-period EMA as the fast-moving and 100 EMA as the slow-moving.

Source: Tradingview.com

The fast-moving EMA will respond to price changes. When it moves below the 100-EMA, it implies a shift in trend from uptrend to downtrend. A swing trader can use this opportunity to enter a short position. If the price remains below the 100 EMA and closes when it moves above the long-term EMA.

Similarly, a swing trader can look to enter a buy position whenever the 21 EMA crosses the 100 EMA and starts moving up. The crossover signals the start of an uptrend. A trader can leave the long position open to accrue gains if the price remains above the two EMA.

Price only sometimes moves in one direction. As a result, a period of exhaustion comes after a significant move in a given direction. Whenever exhaustion kicks in, it presents an opportunity to enter reversal trades or fade the move.

With this swing trading strategy, you must identify strong momentum into a resistance or support level. Look for a strong price rejection at this level with the formation of a bearish candlestick at the resistance or a bullish candlestick at the support. Once the candlestick forms look to enter a trade in the opposite direction of the underlying trend

The EURUSD chart above shows the price moving up in a steep uptrend. However, the pair hits a strong resistance and gets rejected the first time, consequently pulling back. Nevertheless, bulls try to engineer another move up but fail. Forming a bearish candlestick at the resistance level presents an opportunity to enter a short-swing trade.

Source: Tradingwithrayner.com

The best way to trade this price action is to enter a short position when a bearish candlestick emerges at the resistance level. A stop loss should be placed a few pips above the resistance level. The take profit should be before the nearest swing low.

Now that you understand the basics of swing trading, there are some things to always keep in mind. First, ensuring that trades align with the long-term trend is essential. Swing trading is much easier and more effective when trading with the trend. While there might be opportunities to enter reversal trades or fade the move, it is essential to use tight stop loss to avert the risk of incurring significant losses.

Secondly, it is essential to use Moving Averages as they help identify the prevailing trend. Moreover, they make it easy to always trade in the direction of the trend and exit as soon as conditions change.

Additionally, it is essential to use little leverage. When used appropriately, leverage can amplify profits. However, it is a double-edged sword that can also magnify losses.

Swing trading is an ideal strategy when dealing with volatile markets that trigger significant swings in the market. Technical analysis is essential to be consistent in generating swing trading profits. Fundamentals analysis can also come into play to analyze price trends and patterns.

Are you interested in algorithmic trading strategies? Read about algo trading definition, benefits, and disadvantages. Find out if it is profitable and legal.

Do you want to try carry trade? Check out how it works. Carry trade strategy example and possible risks on the Avaprimax Blog. Take advantage of interest rate differential.

Learn more about trend trading and find out strategies for trading using a trend. Strategies for trending market on the Avaprimax Blog.

What is position trading? Positional trading strategies and tips from Avaprimax experts. Check out indicators for positional trading.

Our Avaprimax experts explain the concept of demand and supply. Supply and demand charts, zones, and rules. Check out how to find and trade supply and demand zones.

What is RSI? Read about relative strength index settings and RSI in Forex trading. Discover RSI trading strategies on the Avaprimax Blog.

Are you looking for an easy trading strategy? Explore a simple price action strategy! Read about the horizontal support and resistance level on the Avaprimax Blog.